If you’re considering selling your business, a potential buyer will want to see what assets you have on the balance sheet. If, for example, you have a debit of $1,000 from the purchase of a new computer, you would then create an equal credit for the asset of the computer. However, even though the accounting system is referred to as double-entry, a transaction may involve more than two accounts. A company’s loan payment to its bank is a typical example of a transaction that involves three accounts.

- Assets are resources owned by the company that are expected to provide future benefits.

- Taking the time to understand them now will save you a lot of time and extra work down the road.

- Expenses cause the owner’s equity to decrease and as such should have a debit balance.

- If you take out a loan, for example, you’ll have cash in the bank, but that’s not revenue.

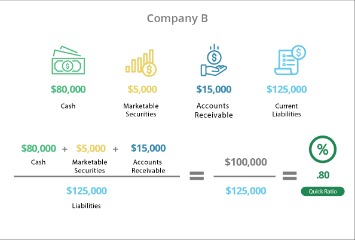

A debit is an accounting entry that results in either an increase in assets or a decrease in liabilities on a company’s balance sheet. In fundamental accounting, debits are balanced by credits, which operate in the exact opposite direction. Debits increase the balance of an expense account, while credits decrease the balance of an asset account. Bookkeepers and accountants use debits and credits to balance each recorded financial transaction for certain accounts on the company’s balance sheet and income statement.

Special considerations: Unusual cases of debits and credits

This is a contra asset account used to record the use of a capital asset. Because this is a contra account, increasing it requires a credit rather than a debit. To record depreciation for the year, Depreciation Expense is debited and the contra asset account Accumulated Depreciation is credited. For instance, if a company purchases supplies on credit, it increases its Accounts Payable—a liability account—by crediting it.

The entries would be a $375 debit to the expense account for office supplies and a credit of $375 to the company’s bank account. To eliminate the confusion around the meanings of debits and credits, one has to accept the concept that the words have no meaning other than left and right. A debit in an accounting entry will decrease an equity or liability account. These steps cover the basic rules for recording debits and credits for the five accounts that are part of the expanded accounting equation. Expense accounts run the gamut from advertising expenses to payroll taxes to office supplies. It’s imperative that you learn how to record correct journal entries for them because you’ll have so many.

- Xero is an easy-to-use online accounting application designed for small businesses.

- Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.

- As mentioned earlier, the profits of the business are claimed by the owners.

- Assets and expenses have natural debit balances, while liabilities and revenues have natural credit balances.

- There are five major accounts that make up a company’s chart of accounts, along with many subaccounts that fall under each category.

With a paper general ledger, the debit side is the left side and the credit side is the right side. Don’t waste hours of work finding and applying for loans you have no how to prepare an income statement chance of getting — get matched based on your business & credit profile today. Business credit cards can help you when your business needs access to cash right away.

Are balance sheet accounts debits or credits?

Refer to the below chart to remember how debits and credits work in different accounts. Remember that debits are always entered on the left and credits on the right. In this article, we break down the basics of recording debit and credit transactions, as well as outline how they function in different types of accounts.

Normal Balances in Accounts

Cutting down costs and expenses can help companies make more money from sales. Nevertheless, if expenses are cut down too much it could also have a detrimental effect. For instance, paying less on advertising in order to reduce costs can also lower the company’s visibility and ability to reach out to potential customers.

What is the difference between debit and credit?

A business might issue a debit note in response to a received credit note. Mistakes (often interest charges and fees) in a sales, purchase, or loan invoice might prompt a firm to issue a debit note to help correct the error. Getting your business’s accounting system in place is one of the most important things you can do as a small business owner. Even if you have a certified public accountant (CPA), accounting software can be a great addition to your business. This number is important to potential investors because it helps them understand your net worth. If they see steady growth in your shareholders’ equity through increased retained earnings, your company may be an appealing investment.

Debits and Credits (Outline)

Expenses are recorded through one of two accounting methods- cash basis or accrual basis accounting. For cash basis accounting, expenses are recorded only when they are paid. Whereas, in the accrual accounting method, expenses are recorded only when they are incurred. The term ‘debits and credits’ is frequently used by bookkeepers and accountants when recording transactions in accounting records.

The easiest way to understand this is to think of the accounting equation and remember what type of account you are dealing with. In this context, debits and credits represent two sides of a transaction. Depending on the type of account impacted by the entry, a debit can increase or decrease the value of the account. Demystify accounting fundamentals with this comprehensive guide to debits and credits, their roles in transactions, and double-entry bookkeeping.